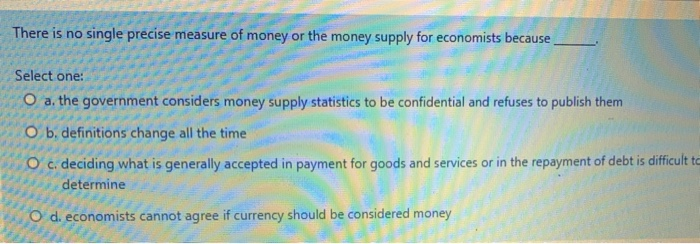

Even economists have no single precise definition of money because it is a complex and multifaceted concept. Money serves as a medium of exchange, a store of value, and a unit of account. Throughout history, various forms of money have been used, from seashells and livestock to gold and paper currency.

The evolution of money has been shaped by technological advancements, economic changes, and the rise of central banks. Central banks play a crucial role in managing the money supply and implementing monetary policy, which aims to achieve economic stability and growth.

The Nature of Money

Money is a widely accepted medium of exchange that facilitates the transfer of goods and services between parties. It serves as a store of value, enabling individuals to preserve their wealth over time, and as a unit of account, providing a common base for comparing the value of different goods and services.

Throughout history, various forms of money have been used, including precious metals (such as gold and silver), livestock, and even seashells. In modern economies, fiat currency, which is issued and backed by governments, is the most common form of money.

The Evolution of Money

Money has evolved from its origins as a physical commodity used for barter to the complex digital forms we use today. The development of money has been influenced by factors such as the growth of trade, the need for more efficient exchange mechanisms, and technological advancements.

In the 21st century, the rise of digital technologies has significantly impacted the evolution of money. Cryptocurrencies, such as Bitcoin, and mobile payment systems, such as Apple Pay, are challenging traditional forms of money and introducing new possibilities for financial transactions.

The Role of Central Banks

Central banks play a crucial role in the monetary system by managing the money supply and regulating the financial system. They use tools such as interest rate adjustments, quantitative easing, and open market operations to influence the availability and cost of money in the economy.

Central bank policies have a significant impact on economic growth, inflation, and unemployment. By controlling the money supply, central banks can stimulate or slow down economic activity and maintain price stability.

Monetary Policy

Monetary policy refers to the actions taken by central banks to manage the money supply and influence economic conditions. The objectives of monetary policy typically include achieving price stability, promoting economic growth, and maintaining financial stability.

Central banks use different types of monetary policy tools, such as open market operations, changes in reserve requirements, and changes in the discount rate, to implement their monetary policy objectives.

The Global Monetary System

The global monetary system is a complex network of institutions, rules, and practices that facilitate international trade and financial transactions. The International Monetary Fund (IMF) and the World Bank play key roles in the global monetary system by providing financial assistance to countries, promoting international cooperation, and monitoring the global economy.

The global monetary system faces challenges such as exchange rate fluctuations, sovereign debt crises, and the rise of cryptocurrencies. These challenges require ongoing cooperation and coordination among countries to maintain a stable and functioning global monetary system.

The Future of Money: Even Economists Have No Single Precise Definition Of Money Because

The future of money is uncertain, but it is likely to be shaped by technological advancements and changing economic conditions. Cryptocurrencies and other new technologies may continue to challenge traditional forms of money and introduce new possibilities for financial transactions.

A cashless society, where physical currency is no longer used, is a potential future scenario. However, the widespread adoption of a cashless society would require significant technological infrastructure and social acceptance.

Query Resolution

What is the main function of money?

Money serves three main functions: medium of exchange, store of value, and unit of account.

How has technology influenced the evolution of money?

Technology has played a significant role in the evolution of money, from the introduction of electronic banking to the rise of cryptocurrencies.

What is the role of central banks in the monetary system?

Central banks are responsible for managing the money supply and implementing monetary policy to achieve economic stability and growth.