Lisa turned 65 and is now eligible – As Lisa embarks on her 65th year, she enters a new chapter marked by significant eligibility milestones and potential life changes. This article delves into the various aspects of Lisa’s eligibility status, exploring the benefits, entitlements, and considerations that come with this milestone.

From healthcare options to retirement planning, this comprehensive guide provides an overview of the key implications of turning 65. By understanding her eligibility status, Lisa can make informed decisions and navigate this transition smoothly.

Eligibility Overview

Turning 65 is a significant milestone that brings about changes in eligibility for various benefits and services. Lisa’s 65th birthday marks her entrance into a new phase of life, accompanied by specific eligibility criteria and requirements.

To be eligible for many government-sponsored programs and benefits, individuals must meet certain age requirements. Turning 65 is a key milestone that triggers eligibility for several programs, including Social Security, Medicare, and other age-based benefits.

In the United States, the full retirement age for Social Security benefits is 66 for those born between 1943 and 1954. However, individuals can start receiving reduced benefits as early as age 62 or delay benefits until age 70 for increased payments.

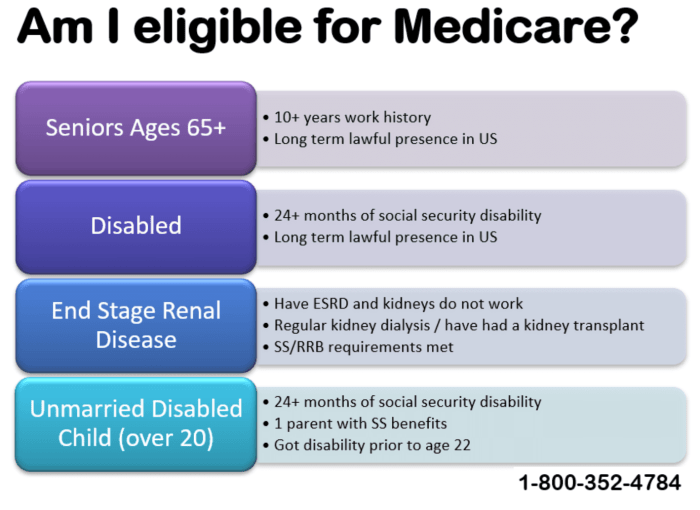

Medicare, the federal health insurance program for individuals aged 65 and older, becomes available upon reaching age 65. Enrollment in Medicare Part A (hospital insurance) is typically automatic, while enrollment in Part B (medical insurance) requires payment of a monthly premium.

Other eligibility criteria may vary depending on the specific program or benefit. For example, some programs may have income or asset limits that affect eligibility. It is advisable for Lisa to research and understand the eligibility requirements for any programs or benefits she may be interested in.

Key Milestones and Events, Lisa turned 65 and is now eligible

- Age 62:Earliest age to receive reduced Social Security benefits.

- Age 65:Eligibility for full Social Security benefits (for those born between 1943 and 1954), Medicare, and other age-based benefits.

- Age 70:Latest age to receive increased Social Security benefits.

Benefits and Entitlements

Upon turning 65, Lisa may be eligible for a range of benefits and entitlements designed to support seniors and provide financial assistance.

Social Security Benefits:Social Security provides monthly retirement benefits to eligible individuals who have paid into the system through payroll taxes. The amount of benefits received is based on earnings history and age at retirement.

Medicare:Medicare is a federal health insurance program that provides coverage for hospital, medical, and prescription drug expenses. Medicare is divided into Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage).

Supplemental Security Income (SSI):SSI is a federal program that provides monthly payments to low-income individuals aged 65 and older, as well as blind or disabled individuals.

Veterans Benefits:Veterans who served in the U.S. military may be eligible for a range of benefits, including healthcare, disability compensation, and pension benefits.

To access these benefits, Lisa will need to apply through the appropriate government agencies. Each program has its own application process and eligibility criteria. It is advisable for Lisa to contact the relevant agencies to obtain more information and guidance.

It is important to note that eligibility for some benefits may be affected by income or asset limits. Lisa should carefully review the eligibility requirements for each program to determine if she qualifies.

Healthcare Considerations

Turning 65 brings about significant changes in healthcare options and considerations for Lisa.

Medicare:Medicare is the primary health insurance program for individuals aged 65 and older. Medicare Part A provides coverage for hospital stays, while Part B covers medical expenses such as doctor visits and outpatient services.

Medicare Advantage (Part C):Medicare Advantage is a type of private health insurance plan that contracts with Medicare to provide Part A and Part B benefits, as well as additional benefits such as prescription drug coverage.

Medicare Part D:Medicare Part D provides prescription drug coverage. Individuals can choose from a variety of Part D plans offered by private insurance companies.

Medigap:Medigap is supplemental insurance that helps cover out-of-pocket costs not covered by Medicare, such as deductibles, copayments, and coinsurance.

Lisa should carefully consider her healthcare needs and financial situation when selecting a health insurance plan. It is advisable to compare different plans and consult with a healthcare professional to make an informed decision.

In addition to Medicare, Lisa may be eligible for other healthcare programs, such as Medicaid or the Veterans Health Administration (VHA), depending on her income and other factors.

Retirement Planning

Turning 65 is an opportune time for Lisa to review and adjust her retirement planning strategies.

Retirement Savings:Lisa should assess her current retirement savings and determine if she has sufficient funds to support her desired retirement lifestyle.

Investment Strategies:Lisa may need to adjust her investment strategies to ensure her retirement savings continue to grow while minimizing risk.

Retirement Income:Lisa should consider her sources of retirement income, such as Social Security benefits, pension payments, and investment earnings, to ensure she has a stable financial foundation.

Estate Planning:As Lisa ages, it becomes increasingly important to plan for the distribution of her assets after her death. Estate planning tools, such as wills and trusts, can help ensure her wishes are carried out and her loved ones are provided for.

Lisa should consult with a financial advisor or estate planning attorney to develop a comprehensive retirement plan that meets her specific needs and goals.

Lifestyle and Social Impact: Lisa Turned 65 And Is Now Eligible

Turning 65 can bring about significant lifestyle changes and social implications for Lisa.

Lifestyle Changes:Lisa may experience changes in her physical health, energy levels, and daily routine as she ages. It is important for her to maintain an active and engaged lifestyle to promote well-being and independence.

Social Impact:Lisa may face social isolation and loneliness as her social circle changes and friends and family pass away. It is crucial for her to maintain social connections and participate in activities that provide a sense of purpose and belonging.

Community Involvement:Lisa can find opportunities for social engagement and support through volunteer work, community groups, and senior centers. Staying involved in her community can enhance her well-being and provide a sense of purpose.

Lisa should embrace the opportunities and challenges that come with this new chapter in her life. By maintaining a positive outlook, staying active, and connecting with others, she can continue to live a fulfilling and meaningful life.

Estate Planning

Estate planning is crucial for Lisa as she ages to ensure her assets are distributed according to her wishes and her loved ones are provided for after her death.

Will:A will is a legal document that Artikels how Lisa’s assets will be distributed after her death. It allows her to specify who will receive her property, appoint an executor to carry out her wishes, and name a guardian for any minor children.

Trust:A trust is a legal arrangement that allows Lisa to transfer her assets to a trustee who will manage and distribute them according to her instructions. Trusts can provide greater control over the distribution of assets and can help avoid probate, which is the legal process of distributing assets after death.

Durable Power of Attorney:A durable power of attorney allows Lisa to appoint someone to make financial and healthcare decisions on her behalf if she becomes incapacitated. This can ensure her wishes are carried out even if she is unable to communicate them herself.

Lisa should consult with an estate planning attorney to create a comprehensive estate plan that meets her specific needs and goals. By doing so, she can provide peace of mind and ensure her wishes are respected after her death.

Answers to Common Questions

What are the key benefits Lisa may be eligible for upon turning 65?

Lisa may be eligible for benefits such as Social Security retirement benefits, Medicare health insurance, and potential tax breaks for seniors.

How can Lisa access and apply for these benefits?

Lisa can access and apply for benefits through the Social Security Administration, Medicare, and the Internal Revenue Service (IRS).

What are some potential income or asset limits that may affect Lisa’s eligibility for benefits?

Certain benefits, such as Supplemental Security Income (SSI), have income and asset limits that may affect Lisa’s eligibility.